Deep Dive into Futarchy and Meta-DAO

Let's learn about Futarchy, the innovative decision-making system

In this article, you will find the answers to the questions "What is Futarchy, how does it work, how can we get involved, what is Meta-DAO and how does it use the Futarchy system?" Before we get to our main topic, we need to learn a few definitions.

What is a Prediction Market?

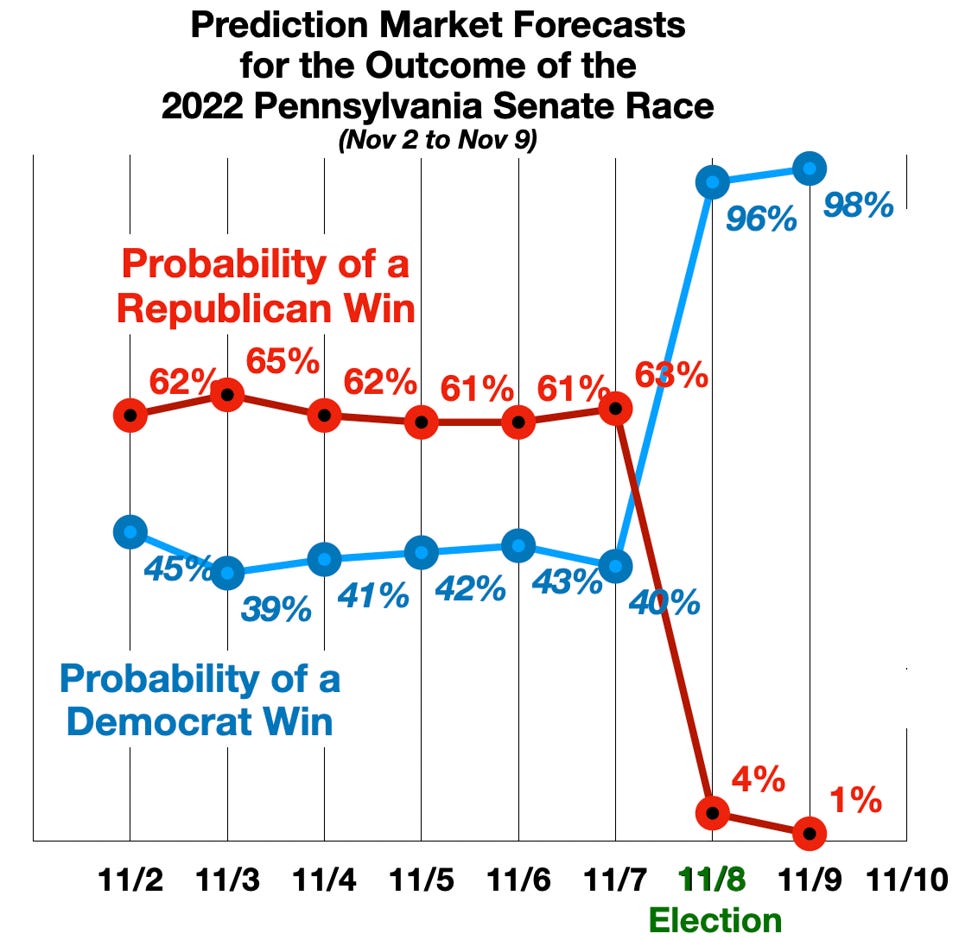

A prediction market is making an inference about a future event. Elections may be included in this event, but it is not limited to elections only. Weather, league results, etc. in a certain period of time. Inferences can also be made and bets can be placed on topics. The prediction market has existed for decades but has become more breathtaking with the blockchain revolution (smart contracts, etc.).

The main purpose of the prediction market is to collect information about people's thoughts, predictions, and beliefs about a future event. The reason why this information provides a higher accuracy rate than the information collected from other tools is that people risk their assets through the bets they make. For this reason, they can provide great assistance in making political decisions.

The classic example often used to explain the prediction market is political elections. Prediction market platforms allow the creation of a survey-like market where participants can trade the results of an election similar to sports betting. Therefore, if a business owner thinks that the election of a particular politician will negatively affect the income of his business, he can bet on a successful election and thus hedge against the disadvantageous outcome.

What is Futarchy?

Futarchy is the use of prediction market data in political decisions in management. First, Robin Hanson's "Shall We Vote on Values, But Bet on Beliefs?" conceptualized in the article. Here, Robin Hanson sheds light on how democracy could improve certain aspects of how it is currently conducted by creating a better way to judge the potential benefits of policy decisions. Despite this, Futarchy has still not found a place for appropriate application in contexts where it can make a difference, such as corporate governance, public policy decisions, or urban planning.

How Futarchy Works:

Prediction Markets:

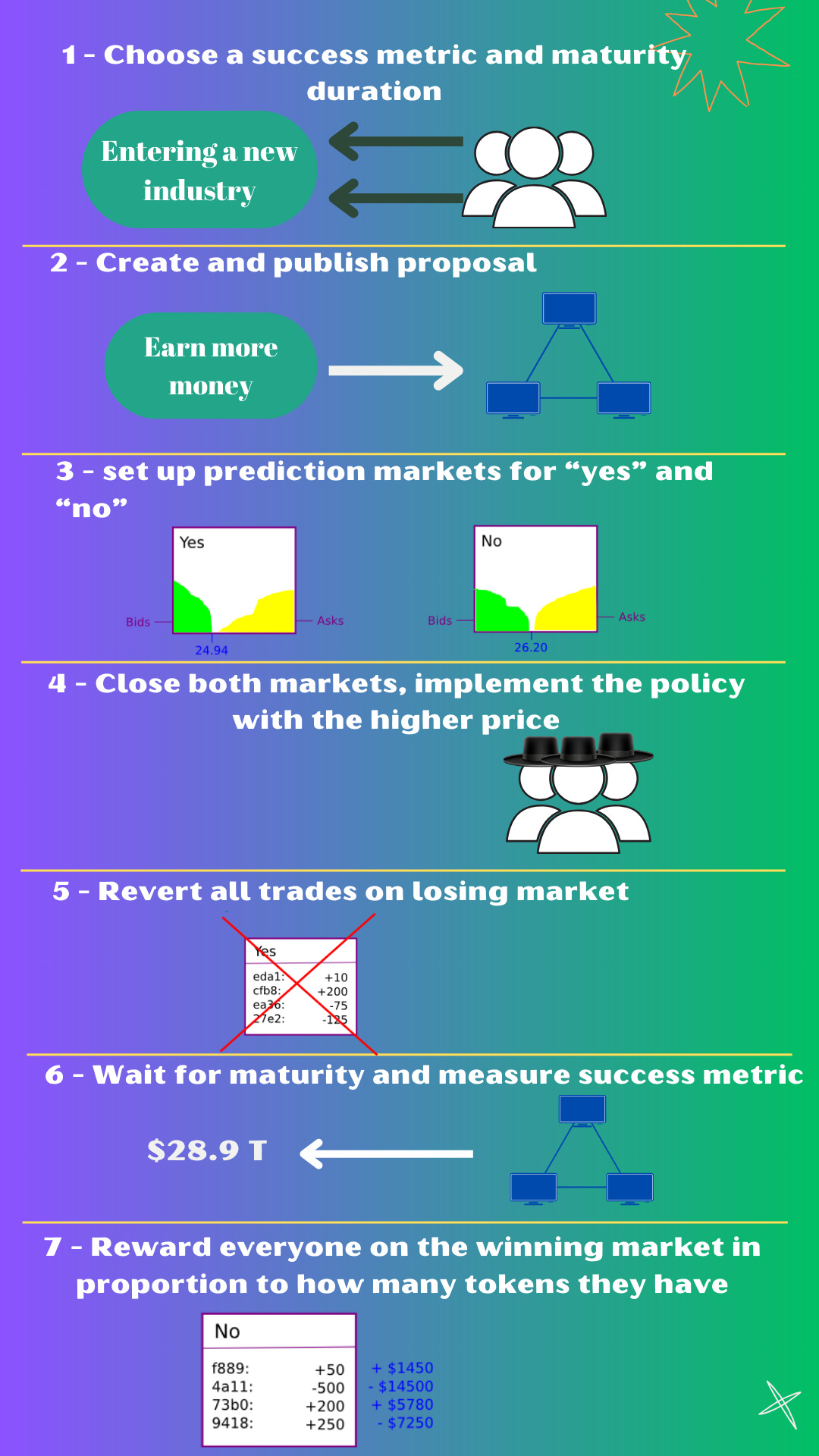

Futarchy relies on prediction markets where participants can trade tokens representing different outcomes of a decision.

Participants use their knowledge and insights to buy or sell tokens related to potential outcomes, reflecting the likelihood of those outcomes occurring.

Decision Proposals:

Decision proposals are put forward, and participants in the prediction market trade tokens based on their predictions of the proposal's consequences.

Proposals can cover a wide range of topics, from policy decisions to project directions.

Market Prices as Decision Metric:

The market prices of tokens serve as an aggregated prediction of the proposal's success or failure.

If the market predicts positive outcomes for a proposal, it indicates potential effectiveness.

Implementation of Decisions:

The decision with the highest market valuation is implemented in the real world.

This approach aligns the interests of participants with the overall success of the organization.

Meta-DAO uses Futarchy on the Solana network. Let's get to know Meta-DAO, which has an innovative approach.

What is Meta-DAO?

Welcome to the exclusive on-chain analytics dashboard for Meta DAO, the pioneering decentralized autonomous organization (DAO) driven by the innovative concept of futarchy. Meta DAO is the first of its kind to integrate futarchy; It is a unique governance model in which decisions are guided by market predictions of outcomes, outside of the traditional voting mechanism. This model leverages the wisdom of the community by using prediction markets to determine the most effective course of action for the DAO.

I want to explain this to you with an example;

a company deciding whether or not to fire the CEO. If the company was run as a futarchy, it would do the following:

1. Create two markets for the company's stock: one 'retain CEO' market and one 'fire CEO' market.

2. Allow investors to trade in these markets for some time period, such as 10 days.

3. After the time has elapsed, look at the time-weighted average price (TWAP) of the company's stock in both markets. If the TWAP is higher in the 'retain CEO' market, retain the CEO and revert all trades in the 'fire CEO' market. If the TWAP is higher in the 'fire CEO' market, fire the CEO and revert all trades in the 'retain CEO market.'

Now let's see how things work in Meta-DAO.

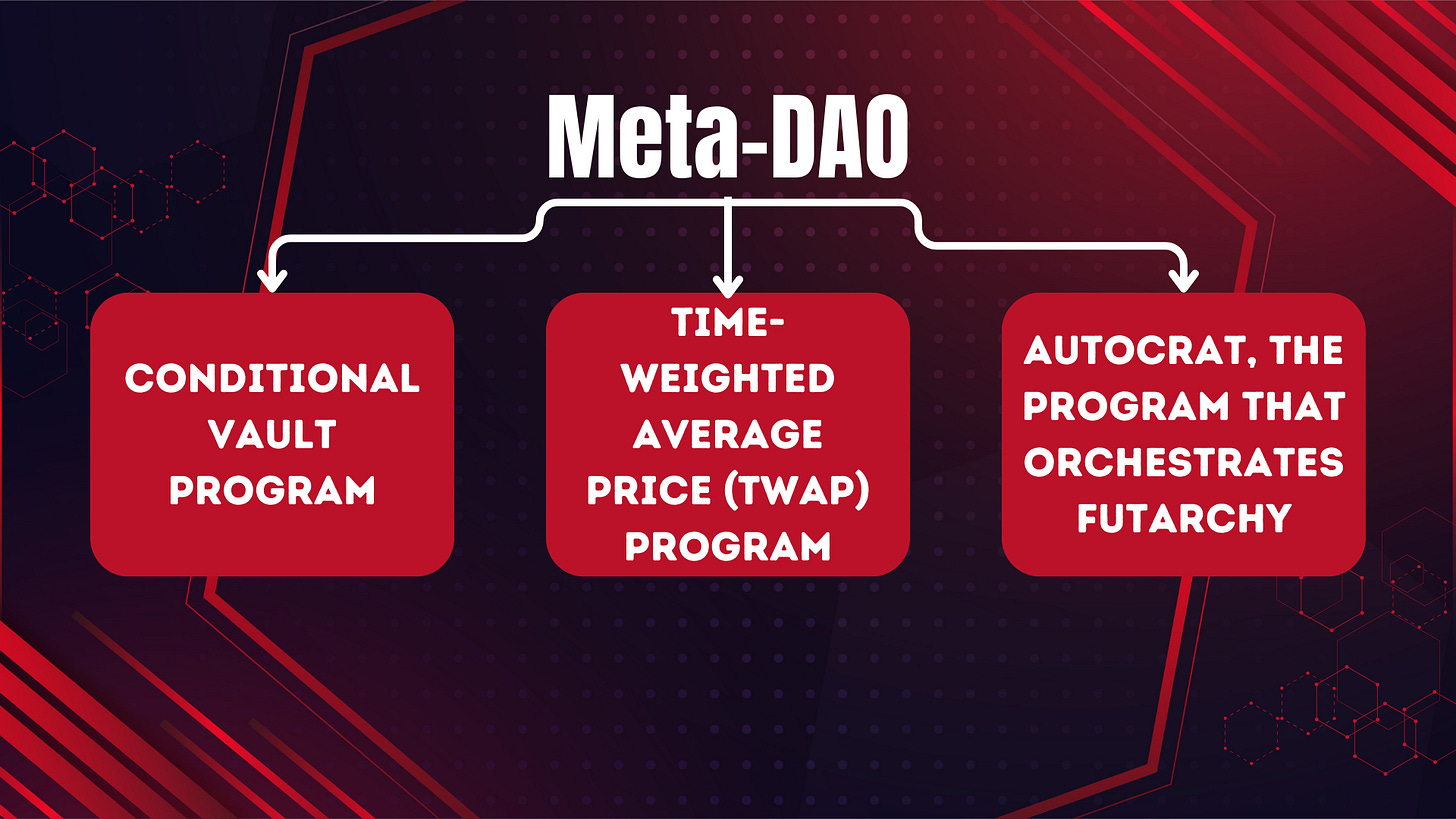

The Meta-DAO is composed of 3 open-source programs on the Solana blockchain:

1-Conditional Vault program,

2-Time-weighted average price (TWAP) program, and autocrat,

3-The program that orchestrates futarchy. All programs are open-source and verifiable.

The Meta-DAO is built on top of OpenBook V2’s central limit order book.

META is the native token of the Meta-DAO.

Conditional Vault Program

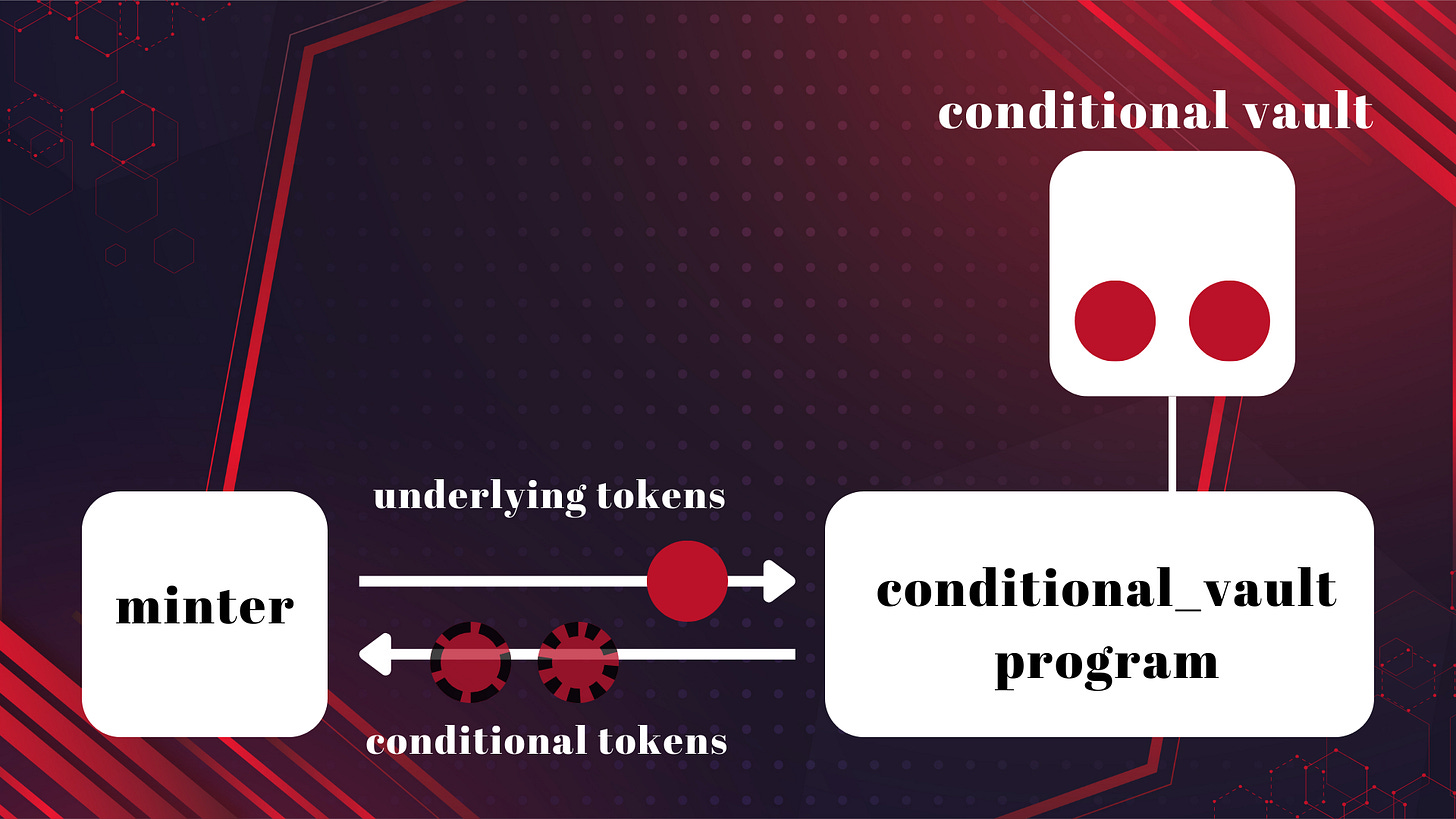

Creating a conditional vault program, as outlined in futarchy, necessitates the incorporation of a mechanism to simulate transaction reversals, given that blockchains inherently lack the capability to revert finalized transactions. This mechanism is achieved through the use of conditional tokens.

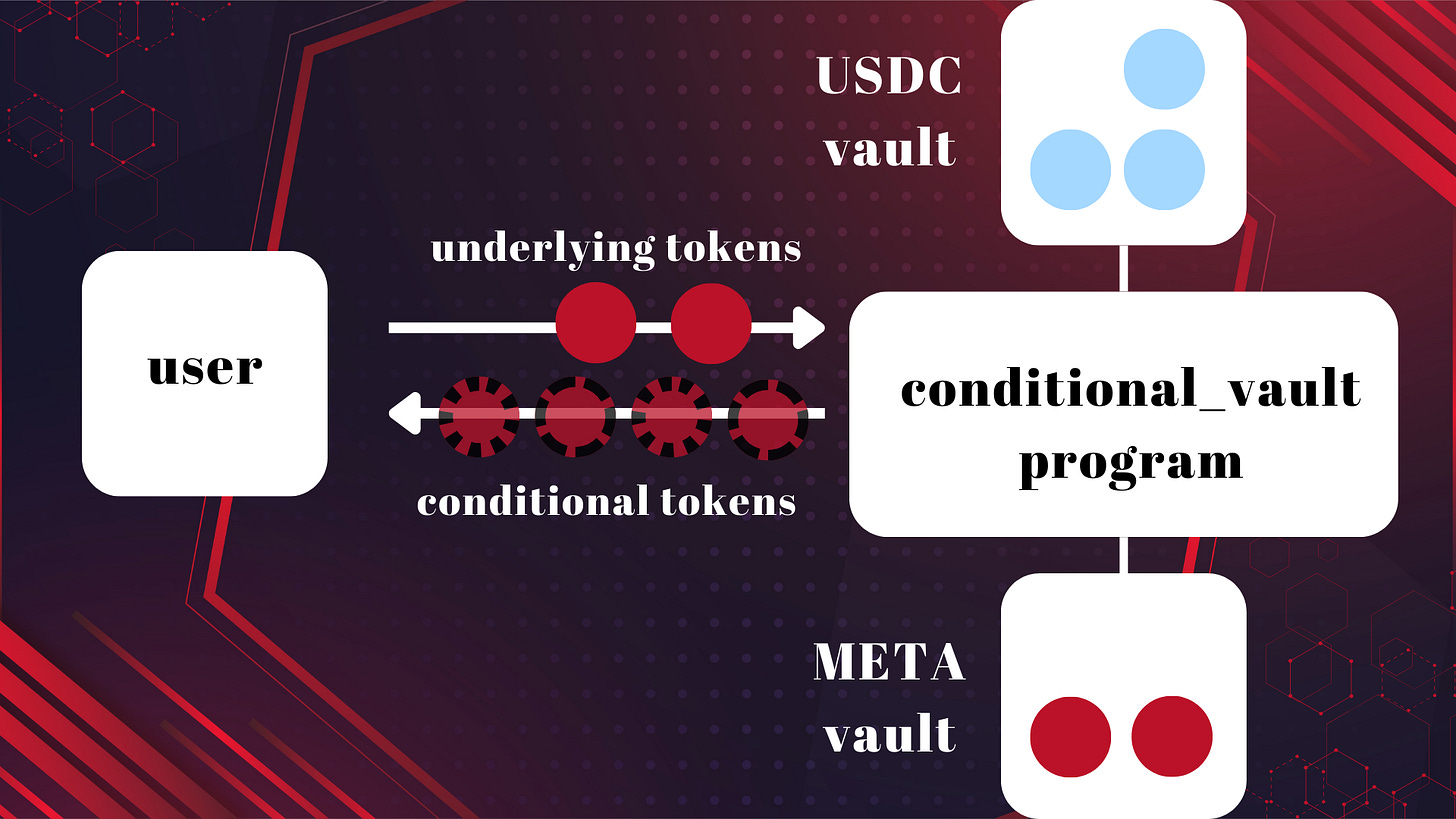

To initiate the process, an individual must establish a conditional vault, each associated with a specific underlying token and settlement authority. In this context, the underlying tokens could be either META or USDC, and the Meta-DAO consistently serves as the settlement authority.

Once the vault is established, any participant has the ability to deposit underlying tokens into the vault in exchange for conditional tokens. There are two distinct types of conditional tokens issued: those redeemable for underlying tokens in the event of vault finalization, and those redeemable if the vault undergoes a reversal. For instance, if you deposit 10 USDC into a vault, you will obtain 10 conditional-on-finalize USDC and 10 conditional-on-revert USDC.

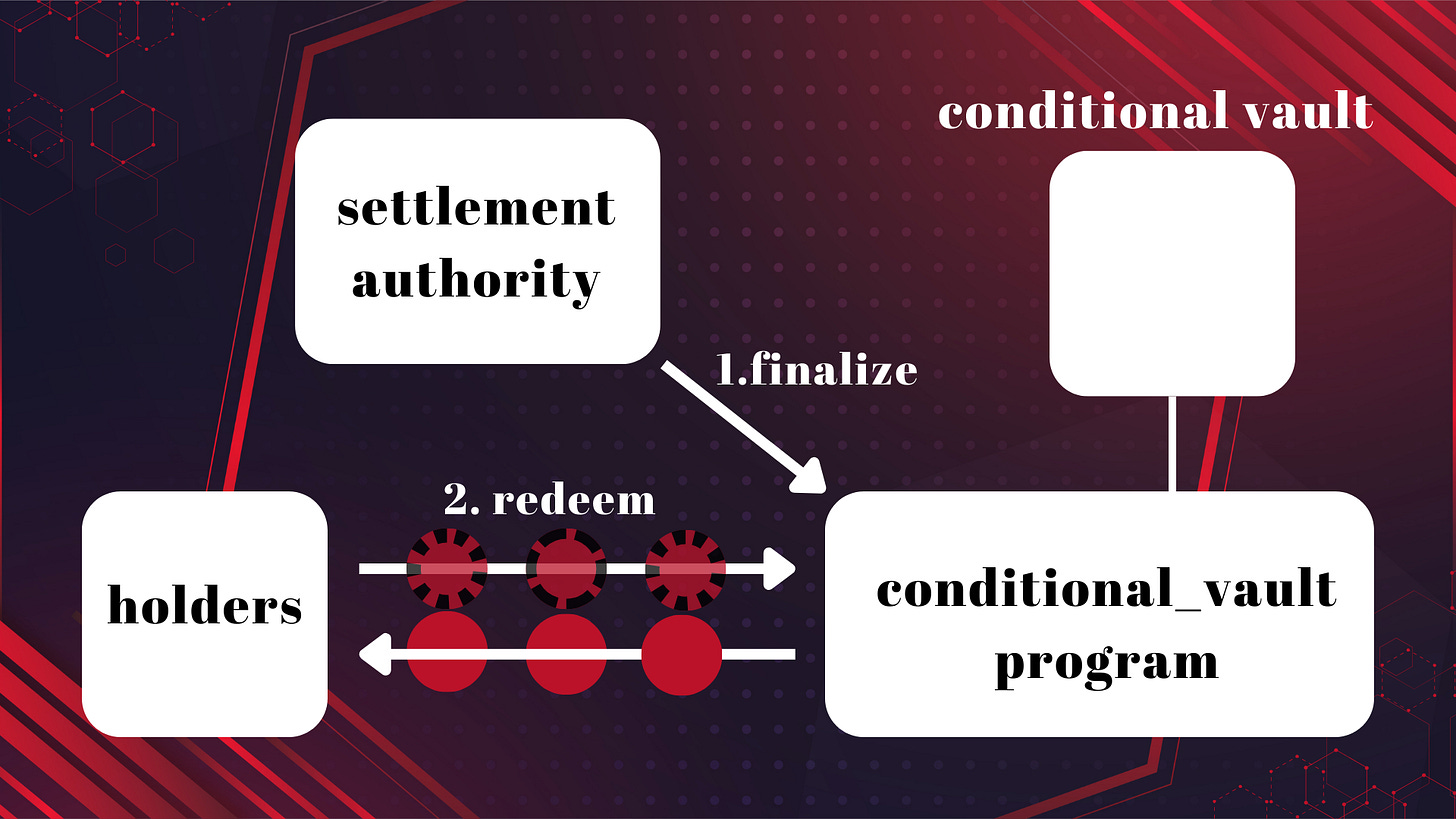

At any given moment, the settlement authority retains the prerogative to either conclude or reverse a vault transaction. In the event of finalization by the settlement authority, holders of conditional-on-finalize tokens gain the ability to exchange their conditional tokens for the corresponding underlying tokens. Conversely, if the settlement authority opts to revert a vault, holders of conditional-on-revert tokens are empowered to redeem their conditional tokens for the underlying assets.

The crucial aspect lies in the mutually exclusive nature of finalization and reverting processes, ensuring that the overall liabilities of the vault never surpass the total assets. This mechanism safeguards against any potential imbalance, maintaining a structured framework where the conditional tokens represent a secure and reliable bridge between the vault's state and the underlying assets

With each proposal put forth, the Meta-DAO initiates the establishment of dual vaults: one designated for USDC and another for META. The outcome of a proposal determines the fate of both vaults; a successful proposal results in the finalization of both vaults, while an unsuccessful one leads to the reverting of both.

In alignment with this operational structure, we designate the conditional-on-finalize tokens as "conditional-on-pass" tokens, signifying their redemption eligibility upon the passage of a proposal. Correspondingly, the conditional-on-revert tokens are termed "conditional-on-fail" tokens, entitling holders to redeem them in the event of a proposal's failure. This nomenclature underscores the clear distinction between the tokens and their associated outcomes, facilitating a transparent and comprehensible framework for participants in the conditional vault program.

This setup facilitates the desired reversal of trades. For instance, if an individual mints conditional-on-pass META and exchanges it for conditional-on-pass USDC, two potential outcomes arise: either the proposal succeeds, enabling them to redeem conditional-on-pass USDC for USDC, or the proposal fails, allowing them to redeem their conditional-on-fail META for their original META.

To operationalize this, two distinct markets are established for each proposal: one where conditional-on-pass META is traded for conditional-on-pass USDC and another where conditional-on-fail META is traded for conditional-on-fail USDC. This dual-market approach empowers traders to articulate nuanced perspectives, such as "this token's value would be $112 if the proposal passes, but it's currently valued at $105 if the proposal fails." This strategy enables participants to navigate the potential outcomes of the proposal, expressing their expectations through the conditional token markets.

TWAP program

The Meta-DAO operates within the framework of OpenBook v2 for all its markets. Recognizing the absence of a Time-Weighted Average Price (TWAP) oracle specifically tailored for OpenBook or any other Solana Automated Market Maker (AMM) or Central Limit Order Book (CLOB), we took the initiative to develop our own TWAP oracle. This oracle is modeled after the design principles of Uniswap V2 and incorporates multiple mechanisms to bolster resistance against manipulation.

Our TWAP oracle not only aligns with the proven design of Uniswap V2 but also integrates additional safeguards to fortify its resilience against potential manipulation. By implementing these mechanisms, we ensure the reliability and integrity of the TWAP data, providing Meta-DAO markets with a robust and secure pricing oracle tailored to the unique characteristics of OpenBook v2 on the Solana blockchain.

Autocrat

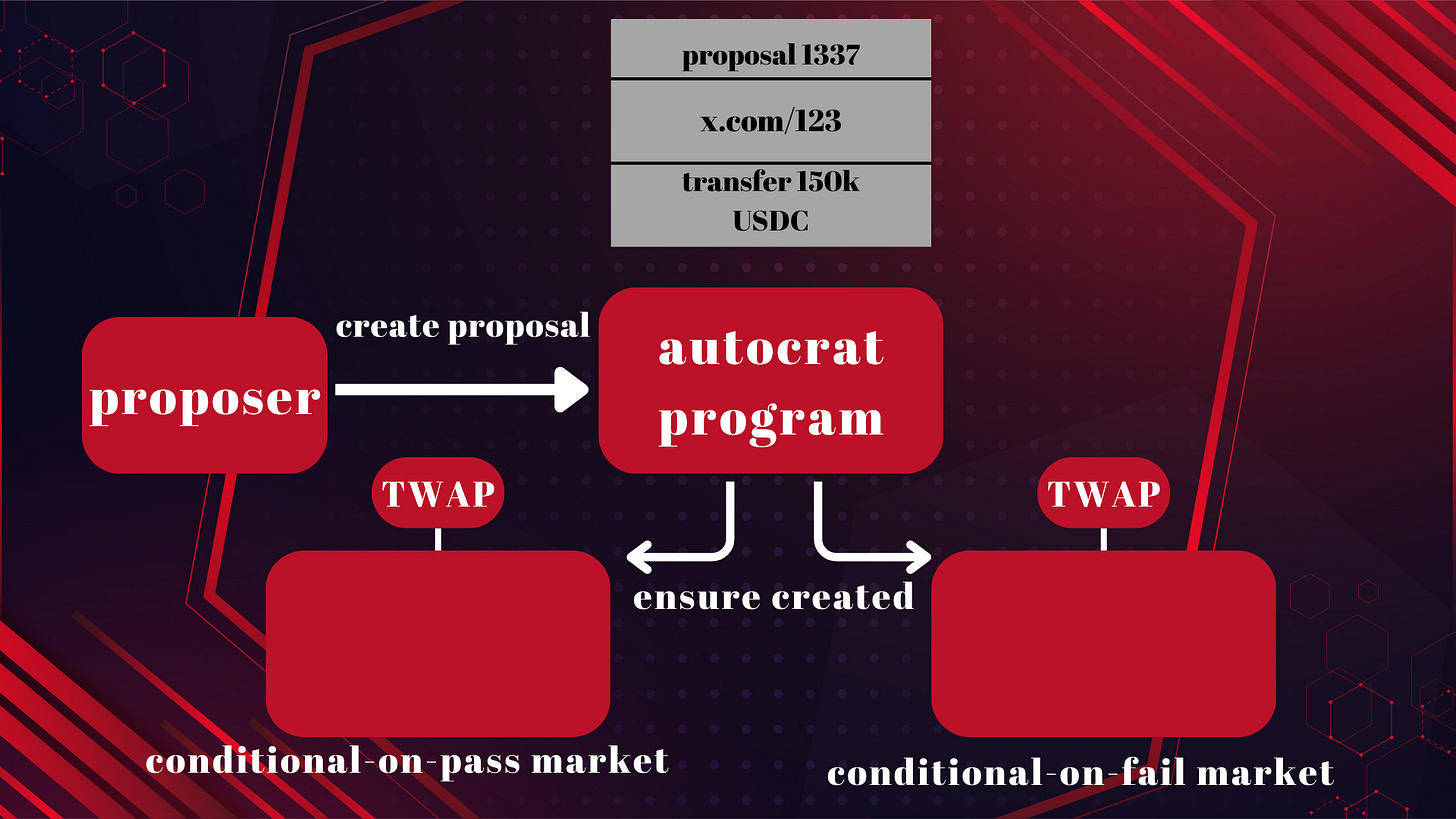

The final component integral to the futarchy orchestration is Autocrat. This program serves as the orchestrator, enabling seamless interaction for the creation of proposals within the Meta-DAO ecosystem. Users have the flexibility to engage with Autocrat and craft proposals, providing essential information such as a unique proposal number, a link to the proposal description, and an executable instruction in the Solana Virtual Machine (SVM).

As an illustrative example, an individual could initiate a proposal suggesting the allocation of 150,000 USDC to a development team tasked with enhancing a product overseen by the Meta-DAO. Simultaneously, Autocrat efficiently generates the requisite conditional vaults and markets, streamlining the entire process. This integrated approach ensures that the necessary infrastructure, including conditional vaults and markets, is established concurrently with the proposal creation, enhancing the efficiency and coherence of the futarchy system within the Meta-DAO.

Following a predefined timeframe, currently set at 10 days, any participant gains the capability to initiate proposal finalization within the Autocrat system. During this finalization process, Autocrat meticulously assesses the Time-Weighted Average Prices (TWAP) of both the pass and fail markets.

In the event that the TWAP of the pass market surpasses that of the fail market, Autocrat seamlessly executes the Solana Virtual Machine (SVM) instruction, formally concludes the pass market, and reverts the fail market. Conversely, if the TWAP of the pass market falls short of the fail market, the Autocrat deems the proposal unsuccessful. In this scenario, the Autocrat proceeds to mark the proposal as failed, concludes the fail market, and initiates the reversal of the pass market.

This configurable and rule-based approach ensures a systematic and objective evaluation of proposal outcomes, with Autocrat employing TWAP differentials to determine the course of action in finalizing markets and executing SVM instructions.

Proposal Review

Now let's look at the proposal that is currently active on Meta-DAO.

Proposal 10 – Increase META Liquidity via a Dutch Auction.

The details and stages of the offer are explained in detail, respectively. According to this proposal, people will vote and action will be taken according to the result.

If you would like to bid on the currently active proposal, you can submit your bid from the link below.

Conclusion

The fusion of Meta-DAO and the Futarchy model represents a groundbreaking shift in organizational governance. Meta-DAO pioneers a market-driven approach, while Futarchy introduces decentralized decision-making through prediction markets. This dynamic combination positions Meta-DAO at the forefront of innovation, offering a glimpse into a future where transparency, decentralization, and adaptability redefine organizational success.

Thank you for reading my article. You can contact me via Gmail for any questions you may have. See you in my next article.

Gmail: serhatgecgin65@gmail.com

References:

https://blog.themetadao.org/a-futards-guide-to-the-meta-dao-7a6b8d66443a

https://en.wikipedia.org/wiki/Futarchy

https://dune.com/metadaohogs/themetadao

https://blog.themetadao.org/from-corporations-to-nations-how-the-meta-dao-is-going-to-change-everything-part-3-16b3880fd86c

https://flipsidecrypto.xyz/pine/meta-dao-metrics-yG-0MP?tabIndex=3

https://twitter.com/MetaDAOProject/status/1729874835462046131

https://docs.themetadao.org/mechanics/implementation

https://medium.com/@patrickmorselli