Deep Dive into Liquid Staking & DeFi

Navigating the Intersection of Liquid Staking and the DeFi Landscape

The burgeoning landscape of decentralized finance (DeFi) within the Solana blockchain has given rise to innovative solutions, and at the forefront is SolBlaze's Liquid Staking ecosystem. In this comprehensive exploration, we delve into the fundamental principles of liquid staking, unraveling the intricacies of how Solana users choose to delegate their SOL tokens to staking pools. SolBlaze, with its BlazeStake and bSOL solutions, takes center stage, offering unique features in the dynamic realm of staking. Beyond a mere technical discourse, we aim to dissect the economic implications, discuss user-controlled delegation systems, and explore the profound impact of liquid staking on the broader Solana DeFi protocols. Join us on this journey as we navigate through the complexities and potentials of SolBlaze's liquid staking and paint a broader picture of the evolving Solana DeFi landscape.

Content Points:

Fundamental Principles of Liquid Staking

Staking Pool Delegation Strategies

User-Controlled Delegation Systems:

DeFi Ecosystem and Liquid Staked Tokens:

Airdrop Strategies and Incentive Mechanisms:

Economic Impacts of Liquid Staking in Solana:

How to Stake Your Sol with SolBlaze

1- Fundamental Principles of Liquid Staking:

In the dynamic realm of decentralized finance (DeFi) within the Solana blockchain, liquid staking stands out as a transformative force reshaping how users engage with their assets. This essay explores the fundamental principles of liquid staking in Solana, shedding light on why it has emerged as a preferred avenue for users seeking to optimize their holdings. At the heart of this exploration is SolBlaze, a key player providing innovative solutions that redefine the staking experience. We'll delve into the essence of liquid staking, examining its conceptual underpinnings, the rationale behind choosing this approach, and the distinctive role that SolBlaze plays in the evolving Solana ecosystem.

What is Liquid Staking in Solana?

At its core, liquid staking represents a paradigm shift in traditional staking models, offering users the flexibility to maintain liquidity while actively participating in staking protocols. In the Solana blockchain, this concept takes form as users lock their SOL tokens into staking pools, earning staking rewards and simultaneously having the flexibility to trade or utilize their staked assets. Unlike traditional staking, where assets are often locked for a specified period, liquid staking introduces a dynamic element, empowering users to make efficient use of their assets within the broader DeFi landscape.

Why choose liquid staking?

Users opt for liquid staking in Solana for several compelling reasons. Firstly, it provides a means to earn staking rewards without sacrificing liquidity, a crucial factor for those seeking to capitalize on market opportunities. The ability to trade staked assets in real-time, coupled with the potential for increased yields, positions liquid staking as an attractive option for both experienced and novice users. Solana's high throughput and low transaction costs further enhance the appeal of liquid staking, making it a practical and cost-effective choice for users navigating the burgeoning DeFi space.

SolBlaze's Role and Innovative Solutions:

In this landscape of evolving possibilities, SolBlaze emerges as a key facilitator, offering solutions that enrich the liquid staking experience. BlazeStake, SolBlaze's flagship product, embodies a user-centric design, allowing seamless delegation of SOL tokens to staking pools. The platform introduces novel features, such as bSOL Private Liquid Staking and BLZE Indicators, providing users with enhanced control and insights into their staked assets. SolBlaze's commitment to user empowerment and innovation reflects a dedication to shaping the future of liquid staking within the Solana ecosystem.

In conclusion, the adoption of liquid staking in Solana, amplified by the offerings of SolBlaze, signifies a transformative step towards a more flexible and dynamic staking experience. As users increasingly recognize the benefits of maintaining liquidity while actively participating in staking, SolBlaze stands as a beacon, illuminating the path toward a decentralized financial landscape where users have the tools and flexibility to maximize the potential of their assets.

2 - SolBlaze's Innovations, Strategies and Principles

The decentralized ethos of blockchain networks extends beyond individual asset management, paving the way for collective endeavors such as staking pools. In the context of Solana's vibrant ecosystem, users embark on the journey of staking pool delegation for multifaceted reasons. This essay delves into the motivations behind users choosing to delegate their SOL to staking pools, elucidates the core principles governing delegation strategies, and explores the distinctive features that SolBlaze's bSOL and BlazeStake bring to the ever-evolving landscape of staking pool dynamics.

Motivations Behind Delegating SOL to Staking Pools:

At the heart of staking pool delegation lies the desire for optimized staking rewards and a simplified participation process. Users recognize that staking pools, by aggregating individual contributions, enhance the chances of consistent and predictable rewards. Delegating SOL tokens to a staking pool also eliminates the need for users to navigate the complexities of running and maintaining their validator node, making staking more accessible to a broader audience. Moreover, participation in staking pools fosters a sense of community, aligning with the collaborative spirit that underpins blockchain networks.

Core Principles Governing Delegation Strategies:

Delegation strategies are rooted in fundamental principles that seek to balance risk, reward, and community engagement. Diversification emerges as a key principle, with users distributing their delegated SOL across multiple staking pools to mitigate the impact of potential node downtimes or variations in performance. Users also consider factors such as the staking pool's historical performance, reliability, and governance structure when formulating their delegation strategies. The dynamic nature of the crypto landscape prompts users to continuously reassess and adapt their strategies to align with evolving market conditions.

Features of SolBlaze's bSOL and BlazeStake:

SolBlaze, as a vanguard in the staking ecosystem, introduces innovative features that augment the delegation experience. BlazeStake, the platform's flagship product, facilitates seamless delegation of SOL tokens to staking pools, prioritizing user-friendly interactions. The introduction of bSOL Private Liquid Staking distinguishes SolBlaze by enabling users to stake their SOL privately, enhancing privacy while benefiting from the advantages of liquid staking. BLZE Indicators further empower users with real-time insights into staking pool performance, aiding in informed decision-making for delegation.

3 - Exploring User-Controlled Delegation Systems in SolBlaze

In the decentralized landscape of blockchain networks, user empowerment takes center stage, and SolBlaze's commitment to this principle shines through its innovative user-controlled delegation systems. This essay navigates the intricate terrain of SolBlaze's bSOL Private Liquid Staking and BLZE Indicators, dissecting the essence of user-controlled delegation and how these features redefine the staking experience within the Solana ecosystem.

User-Controlled Delegation Systems: Unlocking Privacy with bSOL Private Liquid Staking:

SolBlaze's bSOL Private Liquid Staking epitomizes the evolution of user-controlled delegation, introducing a groundbreaking feature that combines the benefits of liquid staking with enhanced privacy. Users can now delegate their SOL tokens to staking pools while maintaining the confidentiality of their holdings. This user-centric innovation allows for more discreet participation in staking without compromising the advantages of liquidity. By putting control firmly in the hands of users, bSOL Private Liquid Staking aligns with the fundamental ethos of decentralized finance, where autonomy and privacy are paramount.

BLZE Indicators: Illuminating the Path to Informed Delegation:

As users navigate the complex landscape of staking pools, the need for transparency and informed decision-making becomes crucial. SolBlaze's BLZE Indicators emerge as a beacon, providing real-time insights into staking pool performance. Delegators can assess factors such as historical performance, uptime, and overall reliability, empowering them to make strategic decisions about where to delegate their assets. This data-driven approach aligns with the ethos of decentralization, where users are not only participants but informed contributors to the network's integrity.

The Synergy of User-Controlled Delegation:

The integration of bSOL Private Liquid Staking and BLZE Indicators forms a symbiotic relationship that amplifies the user experience within SolBlaze's ecosystem. Users can delegate their SOL tokens privately, aligning with the decentralized principles of autonomy and confidentiality. Simultaneously, BLZE Indicators provide the necessary transparency and data-driven insights to ensure that users can make well-informed decisions about their staking pool choices. This synergy redefines the staking landscape, positioning users not merely as participants but as empowered decision-makers in the dynamic Solana ecosystem.

The Impact on the Staking Experience:

The introduction of user-controlled delegation systems elevates the staking experience to new heights. Delegators are no longer passive participants; instead, they become active contributors with the ability to customize their staking strategy based on individual preferences. This level of control not only enhances privacy but also fosters a sense of ownership and responsibility within the decentralized framework.

4 - Transforming DeFi Protocols and Cross-Protocol Dynamics

In the ever-evolving realm of decentralized finance (DeFi), the emergence of liquid staking has brought about a paradigm shift, fundamentally altering the dynamics of how assets are managed and utilized. This essay delves into the profound impact of liquid staking on DeFi protocols within the Solana blockchain, while also engaging in insightful cross-protocol comparisons to unveil the broader implications of this transformative trend.

Impact of Liquid Staking on Solana's DeFi Protocols:

Liquid staking, as a concept, has injected a new layer of flexibility and efficiency into the Solana DeFi ecosystem. Allowing users to stake their tokens while maintaining liquidity, addresses a crucial challenge faced by many DeFi participants. The impact is twofold: users can actively engage in staking to earn rewards while simultaneously utilizing their staked assets within various decentralized applications (DApps) and liquidity pools. This synergy between staking and DeFi protocols promotes a more dynamic and interconnected financial landscape within Solana.

The integration of liquid staked tokens into DeFi protocols has not only expanded the utility of staked assets but has also contributed to the overall liquidity of the DeFi ecosystem. Users can seamlessly move between staking and DeFi activities, leveraging their assets in different ways based on market conditions and personal preferences. As a result, the previously distinct domains of staking and DeFi converge, fostering a more integrated and user-centric financial experience.

Cross-Protocol Comparisons: Learning from Diverse Approaches:

To gain a comprehensive understanding of the impact of liquid staking, it is essential to draw comparisons across various blockchain protocols. Solana's approach, characterized by high throughput and low transaction costs, sets the stage for efficient liquid staking integration. Cross-protocol analysis allows us to observe how different ecosystems address liquidity and staking, shedding light on best practices and potential areas for improvement.

Comparing Solana's liquid staking with other blockchain protocols reveals nuances in design, governance, and user experience. Ethereum, for instance, with its significant user base and diverse DeFi landscape, may showcase different challenges and solutions compared to Solana. Binance Smart Chain, known for its low transaction fees, offers another perspective on how liquid staking aligns with the broader DeFi narrative. These cross-protocol comparisons provide valuable insights that can inform the ongoing development and refinement of liquid staking protocols across different blockchain ecosystems.

The Broader Implications for DeFi Evolution:

As the impact of liquid staking on DeFi protocols becomes increasingly evident, the broader implications for the evolution of decentralized finance come into focus. The integration of staked assets introduces a new dimension of liquidity and flexibility, creating a more resilient and adaptable DeFi ecosystem. This evolution is not limited to Solana but extends to the wider blockchain space, influencing how users interact with their assets and participate in decentralized financial activities.

5 - Airdrop Elevation: Unraveling Strategies in Liquid Staking and the Dynamics of Reward Incentives

In the ever-evolving landscape of decentralized finance (DeFi), the deployment of airdrop strategies within the realm of liquid staking has emerged as a captivating catalyst. This essay aims to delve into the intricacies of airdrop strategies associated with liquid staking while conducting a comprehensive analysis of the reward and incentive mechanisms that underpin this innovative approach.

Airdrop Strategies in Liquid Staking: Unveiling the Dynamics:

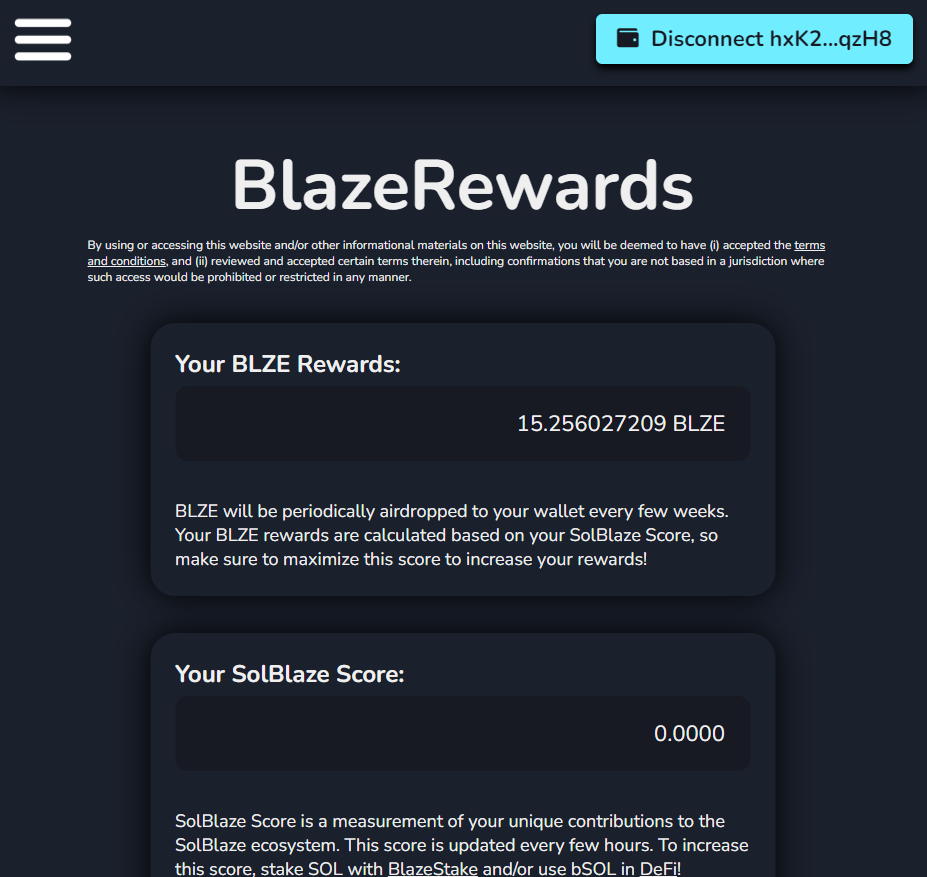

Airdrops, traditionally employed as a means of distributing tokens to a broad user base, have found a new frontier within the realm of liquid staking. This strategic utilization of airdrops serves multiple purposes within the context of staking. Firstly, it acts as a mechanism to incentivize and attract users to participate in liquid staking protocols. By distributing tokens to active stakers, projects create a symbiotic relationship, rewarding users for their engagement while simultaneously fostering liquidity and participation within the staking ecosystem.

Moreover, airdrops in the context of liquid staking often extend beyond a simple distribution of tokens. They may be intricately linked to governance participation, encouraging users not only to stake their assets but actively contribute to the decision-making processes of the underlying protocol. This dual-layered approach not only enhances user engagement but also solidifies the decentralized nature of governance within these ecosystems.

Analysis of Reward and Incentive Mechanisms: Unraveling the Complexities:

The effectiveness of airdrop strategies in liquid staking is inherently tied to the underlying reward and incentive mechanisms. Analyzing these mechanisms unveils the complexities that define user behavior and protocol sustainability. Stakers are not only motivated by the immediate rewards offered through airdrops but also by the long-term benefits derived from consistent staking.

Incentive mechanisms within liquid staking protocols are designed to strike a delicate balance, ensuring that users are adequately rewarded for their commitment while maintaining the economic viability of the protocol. Variable reward structures, often influenced by factors such as staking duration, quantity, and overall protocol health, contribute to a dynamic and responsive incentive system.

Additionally, governance tokens distributed through airdrops may confer voting rights, allowing stakers to actively shape the trajectory of the protocol. This intersection of financial incentives and governance participation creates a robust ecosystem where users are not merely passive participants but active contributors with a stake in the protocol's success.

The Synergy of Airdrop Strategies and Incentives:

The synergy between airdrop strategies and incentive mechanisms forms a symbiotic relationship that drives the success and sustainability of liquid staking protocols. Airdrops act as a catalyst, sparking initial interest and engagement, while well-designed reward and incentive structures ensure that users remain committed contributors over the long term.

As the DeFi landscape continues to evolve, the effectiveness of airdrop strategies and incentive mechanisms will play a pivotal role in determining the success and adoption of liquid staking protocols. A nuanced understanding of user motivations, coupled with innovative approaches to incentivization, will be key in shaping the future of decentralized finance where airdrops serve as not just a promotional tool but an integral component of a thriving and participatory ecosystem.

6 - Navigating the Impact of Liquid Staking on Solana's Validator Operators and Ecosystem Growth

The advent of liquid staking within the Solana blockchain has not only transformed the way users engage with their assets but has also brought forth profound economic implications for validator operators. This essay delves into the intricate economic consequences faced by validator operators and explores the trajectory of the liquid staking ecosystem's growth over time, shedding light on the evolving dynamics within Solana's decentralized finance (DeFi) landscape.

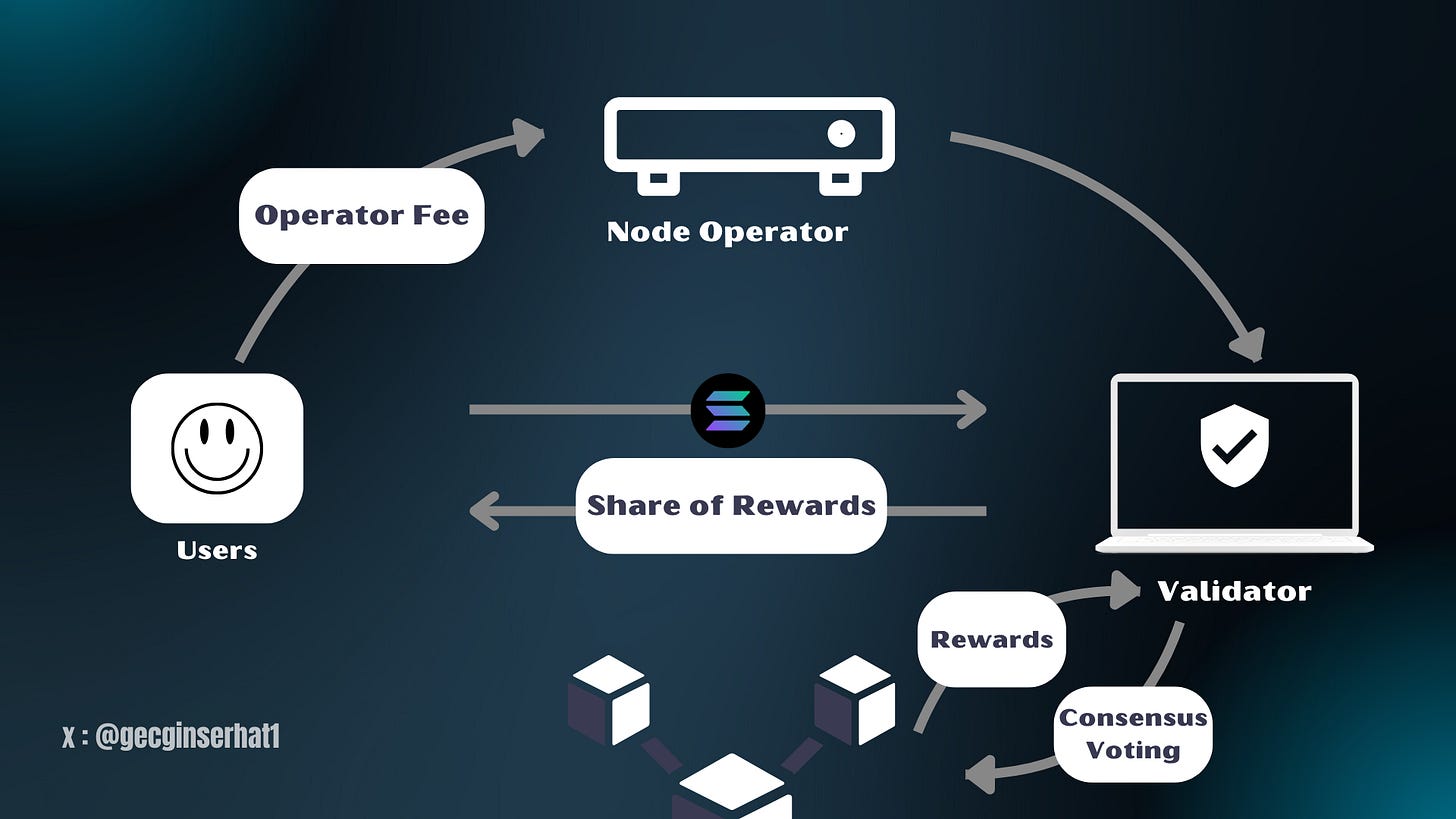

Economic Consequences for Validator Operators: Balancing Act in a Dynamic Landscape:

Validator operators within the Solana ecosystem play a pivotal role in the liquid staking paradigm, acting as the backbone of the network's security and functionality. However, the economic consequences for these operators are nuanced and multifaceted. The introduction of liquid staking disrupts traditional staking models, introducing a layer of flexibility that impacts validator economics.

One of the primary economic shifts for validator operators lies in the potential variations of staked assets. Liquid staking allows users to freely move their staked assets, creating a more dynamic validator environment. Validators need to adapt to the fluidity of staked tokens, navigating potential fluctuations in the assets under their management. This adaptability demands a strategic approach to resource allocation, as operators strive to maintain competitiveness and attract stakers in the liquid staking landscape.

Moreover, validator operators may face challenges related to adjusting their infrastructure to accommodate the increased demand and transaction throughput associated with liquid staking. The economic implications extend to the necessity of efficient operational management and strategic resource deployment to ensure optimal performance and attract stakers seeking reliable and high-yield validation services.

Growth of the Liquid Staking Ecosystem Over Time: Fostering a Flourishing Landscape:

As the economic dynamics for validator operators evolve, the trajectory of the liquid staking ecosystem's growth over time becomes a central point of analysis. The initial stages witness a surge in interest and participation driven by the innovative features of liquid staking, such as maintaining liquidity while earning staking rewards. This surge, however, requires a delicate balance to ensure sustained growth.

Over time, the liquid staking ecosystem is poised to mature, finding equilibrium between user demand, validator capabilities, and the economic incentives provided. Validator operators that successfully navigate the initial challenges and align their strategies with the evolving needs of users stand to benefit from the long-term growth potential.

The growth of the liquid staking ecosystem also relies heavily on the development of ancillary services and tools that enhance the overall user experience. Innovations in user interfaces, educational resources, and governance mechanisms contribute to the ecosystem's resilience and attractiveness. Collaborative efforts among validator operators, developers, and the broader community play a crucial role in fostering an ecosystem that not only sustains growth but also thrives over time.

7 - How to Stake your Solana with SolBlaze

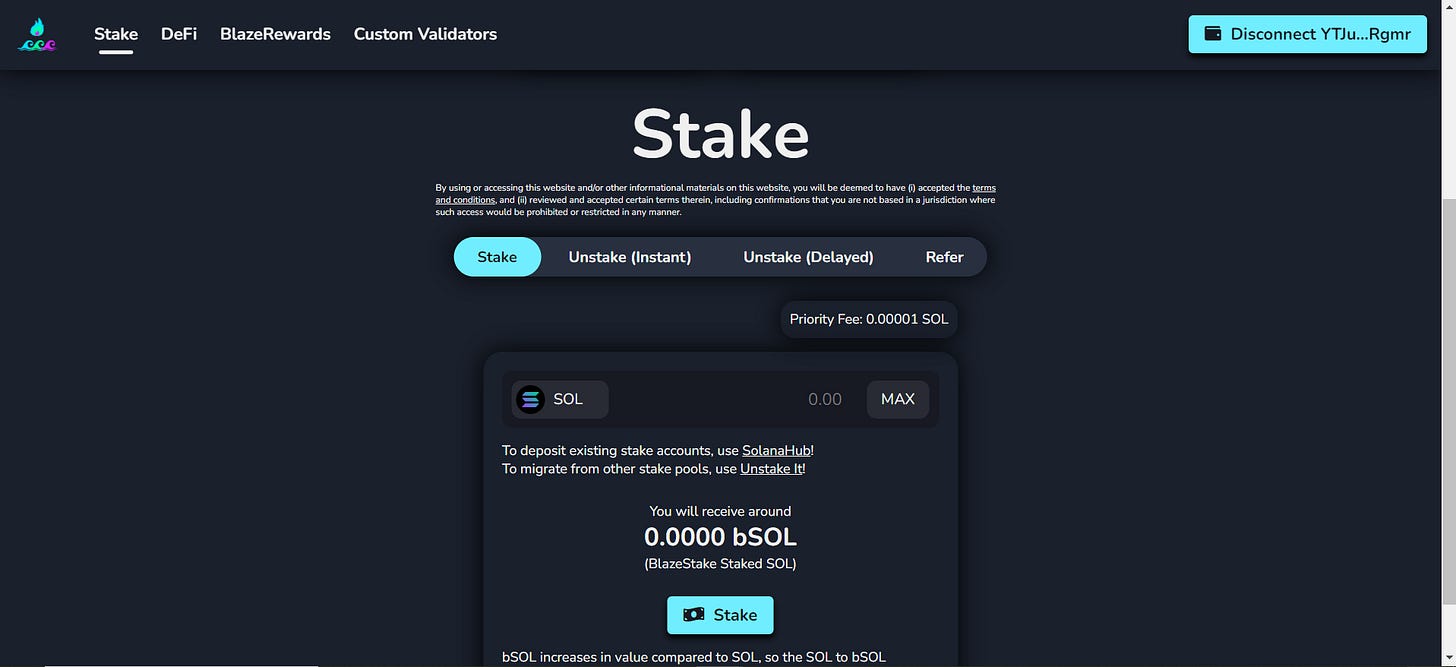

Obtaining Liquid Staking Tokens through SolBlaze is a straightforward process that allows users to leverage their staked assets while retaining liquidity. Follow these steps to embark on the journey of liquid staking:

Visit SolBlaze's Staking Platform: Navigate to the SolBlaze staking platform by going to https://stake.solblaze.org/app/.

Connect Your Solana Wallet: Connect your Solana wallet to the platform. Popular wallet options include Phantom and Solflare. This step ensures a secure connection between your wallet and the staking platform.

Deposit SOL into the Staking Pool: Enter the amount of SOL you wish to deposit. Alternatively, use the MAX option to stake all your SOL, considering gas fees. This process involves locking up your SOL tokens in the staking pool.

Confirm the Transaction: Confirm the transaction to execute the staking process. This step finalizes your decision to stake the specified amount of SOL in the SolBlaze staking pool.

Receive bSOL (Liquid Staked Token): After a successful staking transaction, you will receive an equivalent amount of bSOL, representing your staked SOL. These Liquid Staking Tokens are tradable and can be utilized in various DeFi protocols.

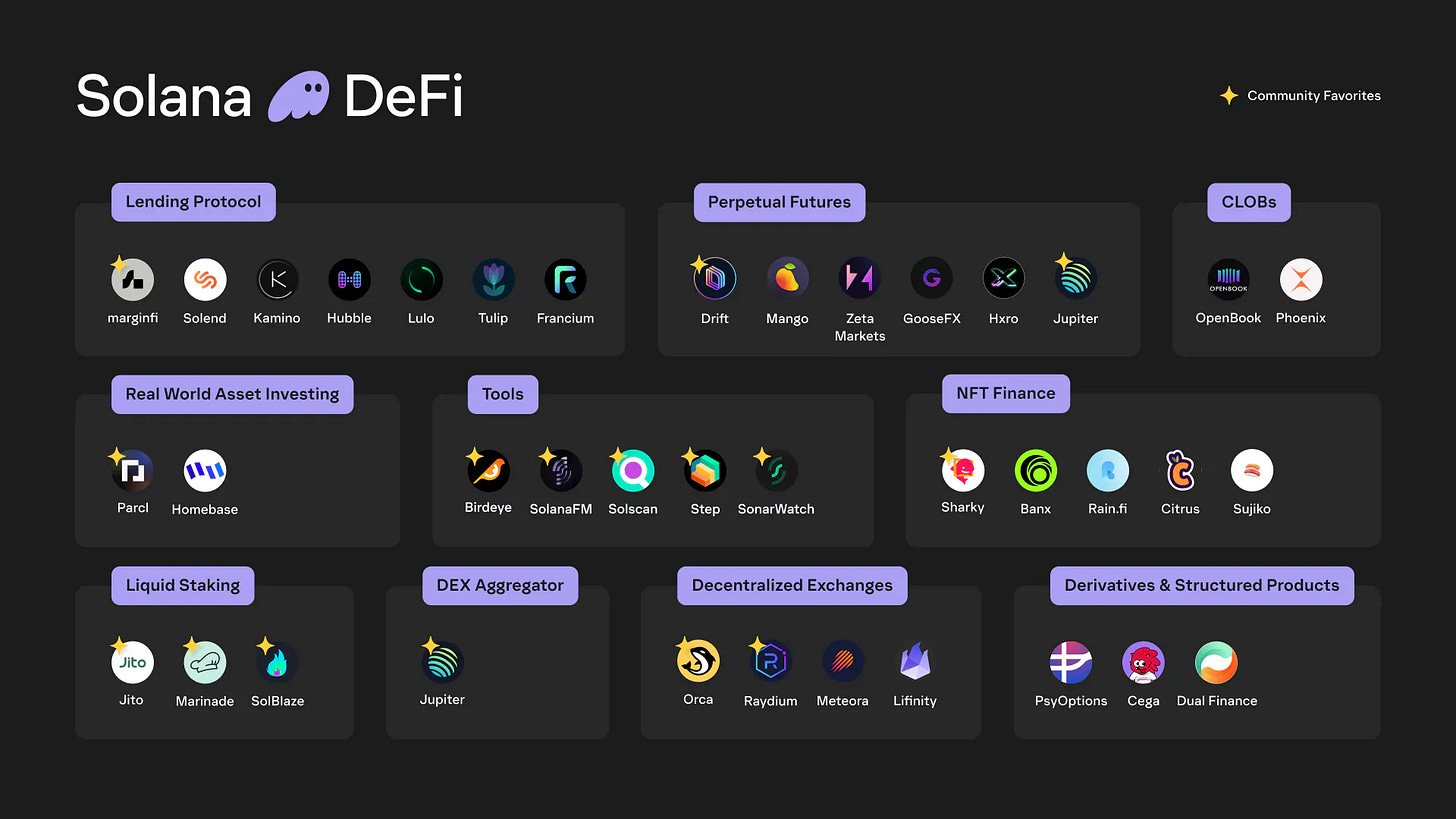

Explore DeFi Opportunities: With your acquired bSOL, you can explore different DeFi opportunities. Supply, swap, or stake your bSOL in various DeFi protocols like MarginFi, Solend, Kamino, Mango Markets, making yourself eligible for a range of rewards – from airdrops to liquidity and lending/borrowing fees.

By following these simple steps, users can seamlessly transition from staking their SOL to holding and utilizing Liquid Staking Tokens through SolBlaze. This approach provides both liquidity and the potential for additional earnings within the vibrant Solana DeFi ecosystem.

Conclusion:

Shaping Solana's Future with SolBlaze and Liquid Staking

In the fast-evolving world of decentralized finance, SolBlaze and liquid staking stand at the forefront of innovation within the Solana blockchain. The user-centric design of SolBlaze's solutions, such as BlazeStake and bSOL Private Liquid Staking, reflects a commitment to privacy and empowerment.

The economic impact on validator operators showcases the potential for sustainable growth, while the intricate strategies of staking pool delegation and user-controlled systems underscore a delicate balance between user autonomy and informed decision-making.

As liquid staking reshapes DeFi protocols, Solana emerges as a unique player, offering a convergence of liquidity and staking. Looking ahead, potential use cases from enhanced liquidity to privacy-focused staking paint a diverse future, and trends suggest continued growth in validator operators and integration with emerging DeFi landscapes.

In conclusion, SolBlaze and liquid staking position Solana as a dynamic force in decentralized finance. This transformative journey, marked by innovation and adaptability, signals not just a moment but a defining era in the decentralized financial evolution.

References:

https://stake.solblaze.org/

https://rewards.solblaze.org/burn

https://stake-docs.solblaze.org/